Structured settlements; very important for buyers and sellers of structured settlements and insurance industry.

Hartford Life Insurance Company, as a top provider in the structured settlement market, has issued more than 40,000 structured settlement annuities as of July, 2005.

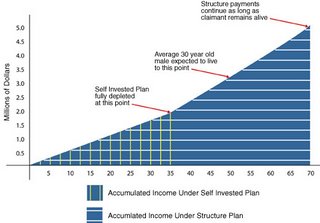

A structured settlement involves a financial or insurance arrangement which includes a periodic cash flow stream of payments, that a claimant or plaintiff accepts in order to resolve a personal injury claim or other legal case. They were first utilized during the 1970s as an alternative to lump sum payments and are now part of the statutory tort law of several common law countries. Structured settlements are an innovative method of compensating injury victims. Encouraged by the U.S. Congress since 1982, it is a completely voluntary agreement between the injury victim and the defendant. Under a structured settlement, an injury victim doesn't receive compensation for his or her injuries in one lump sum. Rather, they will receive a stream of payments tailored to meet future medical expenses and basic living needs.

A structured settlement is a deferred payment method for compensating injury victims, and is a voluntary agreement between the injury victim, plaintiff and the defendant. The plaintiff will receive the monetary payout over the course of a number of years through this deferred payment agreement.

Want to sell your structured settlement?

The United States defines “structured settlement” for Federal income taxation purposes in Internal Revenue Code Section 5891 (c) (1) as an "arrangement" that meets the following requirements:

A structured settlement must be established by:

A suit or agreement for periodic payment of damages excludable from gross income under Internal Revenue Code Section 104(a)(2); or

An agreement for the periodic payment of compensation under any workers’ compensation law excludable under Internal Revenue Code Section 104(a)(1); and

The periodic payments must be of the character described in subparagraphs (A) and (B) of Internal Revenue Code Section 130(c)(2) and must be payable by a person who:

Is a party to the suit or agreement or to a workers compensation claims; or

By a person who has assumed the liability for such periodic payments under a Qualified Assignment in accordance with Internal Revenue Code Section 130.

Hot and Sexy New Myanmar Model Shwe Sin| Hot Photo Set

-

Hot and Sexy New Myanmar Model Shwe Sin| Hot Photo Set

The hot photo set of new sexy Myanmar model Shwe Sin. The colors are hot

pink,black and bright yello...

Megan_Fox_6+copy.jpg)

0 comments:

Post a Comment